Chile's border closure will push the price of copper to continue to rise in the near future!

In response to the rapid increase in the number of cases caused by the new crown virus, the Chilean government decided to close the border from April 5 to May 1. International transportation is only allowed for emergency, humanitarian reasons or medical purposes.

Chile has more than one-third of the world's copper reserves and is the world's largest copper producer. The news of Chile's border closure also triggered market concerns about copper supply. The Chilean Ministry of Energy and Mining previously responded that the border closure will not affect maritime transportation and the normal operation of mining enterprises.

Nevertheless, the price of copper futures on the London Metal Exchange rose 3.6% on April 6, breaking the US$9,000 per ton mark to US$9,104 per ton. Then it rushed higher and fell back, hovering between US$8900 and US$9000.

In fact, at the beginning of 2021, copper prices have set a new high in the past ten years one after another, and at the end of February it once exceeded $9,500. After the shock correction, it remained at around $9,000. As of the close of April 9th, London Copper reported $8929, down 0.89%.

Shanghai copper also set a new high since August 2011 in late February, breaking through 70,000 yuan. As of the close on April 9, Shanghai Copper reported 66,280 yuan, down 0.88%. Many views believe that as global demand recovers and supply slows, copper prices will rise further.

Goldman Sachs believes that copper has more room for price increases in the future. Because copper is also one of the indispensable metals for the green industry, among the major economies in the world, the green industry is currently a well-deserved hot spot.

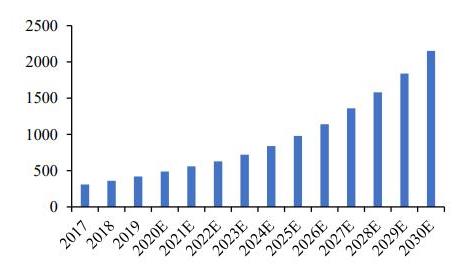

It is estimated that copper demand related to the green industry will reach 1.1 million tons this year. According to the bank’s basic assumptions, it will reach 3 million tons in 2025, and by 2030, it will reach 6.2 million tons.

The Fed maintains its easing policy, the inflection point of global liquidity has not yet reached, and the gradual upward inflation under the economic recovery, superimposed on the global explicit inventory near the lowest position in history, and destocking under the tight balance of industry supply and demand, will be from both financial attributes and commodity attributes. Work together to push up the price of copper.

Data show that copper stocks are still accumulating, but with the arrival of the post-epidemic period, copper demand is also recovering.

According to data released by the London Metal Exchange, since March, copper inventories on the exchange have continued to rise from a low of more than 70,000 tons. As of April 6, the inventory rose to 142,550 tons, a three-and-a-half-month high. The cumulative increase in inventory in March Over 90%.

On the demand side, areas such as new energy will become the main growth points for copper consumption. "Photovoltaics, new energy vehicles and wind power are the three sectors, the proportion of consumption may rise to 14% of the total by 2025, and the global copper consumption of these three items will reach 36.48 billion tons.

Therefore, judging from the three aggregated data, this amount is not small. In the future, the impact of new energy on copper consumption will increase year by year. "

Fitch, an international credit rating agency, predicts that global copper consumption will increase by 2.9% in 2021; the agency raised its estimate of the average copper price in 2021 from US$6,800 to US$7,250.

The agency said that although copper prices will be in a correction phase from the current stage, but because the global economic recovery supports demand, copper supply will continue to be short. It is expected that copper prices in 2021 will still be higher than the average price of the past seven years.

Copper Pipe Fittings Supplier

Winland Metal supplies copper pipe and fittings for plumbing, HVACR, medical & gas, construction and other industires.

Email us to get free quotation

Copper Pipe Copper Fittings Copper Prices