Chile maintains stable production and puts pressure on copper prices

On Monday, on fears of falling demand and rising inventories of copper so that copper prices under pressure, the London Metal Exchange (LME) benchmark copper prices fell 0.76%, to 8861 dollars per tonne. However, the International Monetary Fund (IMF) recently urged governments around the world to seize the opportunity of low interest rates to invest in infrastructure to promote the recovery from the impact of the epidemic and the transition to greener energy. Green energy and infrastructure investment in various countries may bring bright prospects for the long-term prospects of industrial metals.

Outbreak of the largest producing area, copper enterprises make every effort to maintain stable output

This month, the number of cases in Chile soared to the highest level since the outbreak, causing the hospital to nearly collapse, prompting the authorities to block the capital Santiago and close the border of this South American country. Chile supplies more than a quarter of the world's copper mines. The news once caused copper prices to soar.

However, the chief executive officer of Anglo American in Chile said that the return of the new crown epidemic in Chile should not affect the company's production of this year's huge copper mine in this Andean country, nor is it likely to cause short-term supply chain problems. Aaron Puna, chief executive officer of Anglo American Group Chile, said that the company's Chilean business has withstood the impact of the epidemic in its best condition, and that they are prepared to deal with the surge in the latest cases and restrictions. Pune said in an interview: "There is no worry at the moment. We will deliver the goods exactly on budget."

Juan Benavides, chairman of Codelco, the world's largest copper company, also said in an interview that although Chile's infection cases have surged, Codelco still figured out ways to increase production in the first quarter. "From this year to the present, our output has not decreased but increased"

Green energy and infrastructure projects light up the prospects of industrial metals

The International Monetary Fund (IMF) recently urged governments around the world to seize the opportunity of low interest rates to invest in infrastructure to promote the recovery from the impact of the epidemic and the transition to greener energy. Green energy and infrastructure investment in various countries may bring bright prospects for the long-term prospects of industrial metals.

Earlier this month, US President Biden announced his ambitious US$2.3 trillion green energy and infrastructure spending plan to promote the transformation of the US economy. Biden’s new plan will include investing hundreds of billions of dollars to improve America’s aging roads, bridges, schools, railroads, waterways, airports and mobile phone networks.

Large-scale green energy and infrastructure spending plans ultimately mean that the United States will need a lot of commodities. Especially industrial metals, including copper, palladium, platinum, silver, lithium, nickel and rare earth metals used in batteries and 5G technology.

But Republicans have been cautious about the plan. Hansen said: "I think there are still many uncertainties about whether Biden can pass his infrastructure bill."

It is worth noting that LME copper stocks hit their highest level in five months on Monday and have more than doubled since the beginning of March. Yangshan Copper’s premium fell to US$51 per ton, the lowest level since November 20.

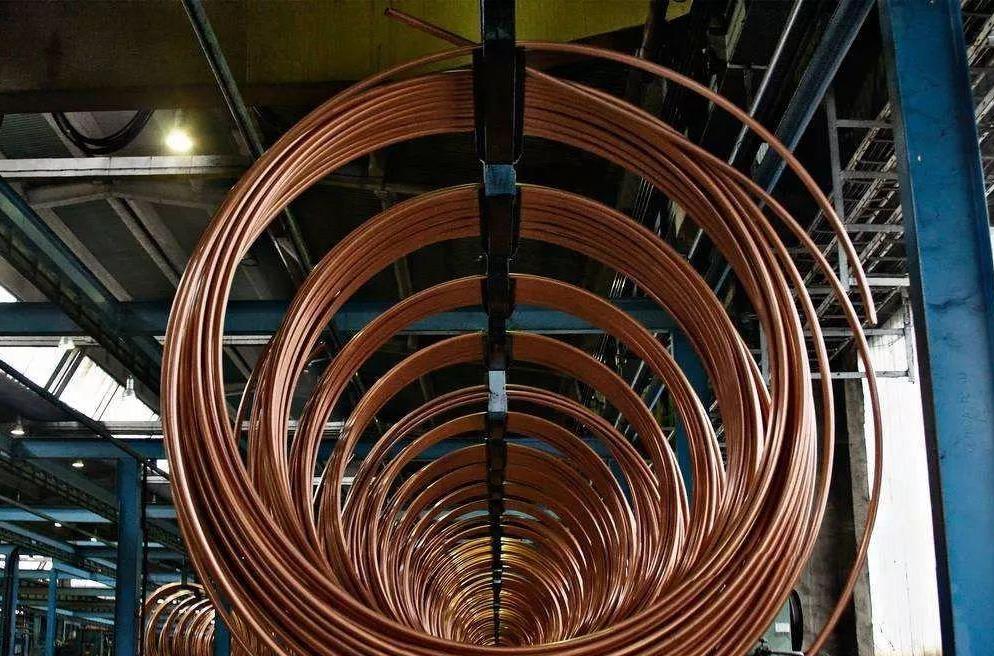

Copper Pipe Fittings Supplier

Winland Metal supplies copper pipe and fittings for plumbing, HVACR, medical & gas, construction and other industires.

Email us to get free quotation

Copper Pipe Copper Fittings Copper Prices